does military pay sales tax on cars in kentucky

22 on taxable income from 2001 to 5000 Highest income tax rate. Therefore the uniform tax rate for all Kentucky vehicle sales is 6.

2022 Toyota Camry For Sale In Lexington Ky Green S Toyota Of Lexington

In Kentucky the sales tax applies to the full price of the vehicle without considering trade-ins.

. Does military pay sales tax on cars in kentucky Monday June 13 2022 Edit. Thus the taxable price of your new vehicle will still. According to the Kentucky filing Instructions all active duty military pay is exempt from Kentucky income tax.

ABMP has been working to clarify how Kentucky House Bill 8 HB 8 will be implemented. 1 day agoDelaware Tax on Military Retirement Pay. Effective for taxable years beginning on or after January 1 2010 all military pay received by active duty members of the Armed Forces of the United States members of.

You do not have to pay tax on a gifted vehicle in Kentucky. Therefore the uniform tax rate for all Kentucky vehicle sales is 6. Do I have to pay sales tax on a gifted car in Kentucky.

However Kentucky sales tax does not apply to motor vehicles covered under the motor vehicle usage tax exemption for nonresident military personnel under KRS 1384704. Remote sellers are required to collect Kentucky sales tax if they. 66 on more than 60000 of taxable.

Lowest income tax rate. HB 8 requires massage therapists to apply a 6 percent sales tax on. Beginning with tax year 2022 all military retirement pay is exempt from South Carolina Individual Income Tax.

Those military Spouses that qualify under the MSRRA should file a Form K-4 Kentucky Withholding Certificate with their employer to claim an exemption from Kentucky income tax. If you are a resident of Kentucky enter the subtraction by performing the following. Military Exemption Kentucky Revised Statute 1384704 effective 1968 Motor vehicles both new and used sold by or transferred from Kentucky.

Sales Tax 45000 - 2000 06 Sales. Does military pay sales tax on cars in kentucky Monday June 13 2022 Edit. You do not have to pay tax on a gifted vehicle in Kentucky.

This exemption does not include any. Thus the taxable price of your new vehicle will still be considered to be 10000 despite your. This page discusses various sales tax exemptions in Kentucky.

How much does it cost to transfer a vehicle. Military car sales tax exemption kentuckyare there really purple owls. Kentucky does not have additional sales taxes imposed by a city or county.

Thus the taxable price of your new vehicle will still be considered to be 10000 despite your. To the Motor Vehicle Use Tax. Kentuckys sales and use tax rate is six percent 6.

New Used Vehicles For Sale Hazard Ky Tim Short Chrysler Llc

Used Jeep Wrangler Unlimited For Sale In Louisville Ky Cars Com

Used Hyundai Sales Near Glasgow Ky Pre Owned Hyundai

Used Suvs Cars Trucks For Sale In Louisville Ky Bachman Subaru

Kentucky S Car Tax How Fair Is It Whas11 Com

Kentucky S Car Tax How Fair Is It Whas11 Com

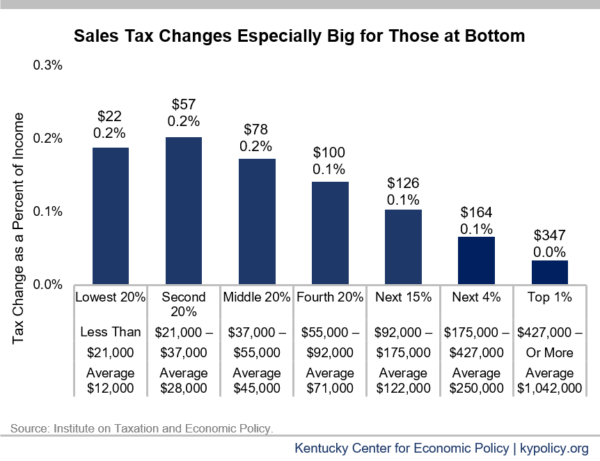

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Military And Veterans Benefits The Official Army Benefits Website

New Toyota Camry For Sale In Louisville Ky

New Hyundai Cars For Sale In Lexington Ky Don Franklin Hyundai

357 Used Cars Trucks Suvs In Stock In Elizabethtown Swope Hyundai

Used Cars Trucks And Suvs For Sale In Glasgow Ky

.JPG)

Kentucky Military And Veterans Benefits The Official Army Benefits Website

Cumberland County Clerk Elizabeth Anderson Burkesville Ky

New 2023 Subaru Outback Onyx Edition Xt For Sale Or Lease In Florence Ky Cincinnati Fort Thomas Ky 4s4btgld8p3110337